Managing money can feel overwhelming, especially when juggling bills, rent, and unexpected costs. I used to struggle with budgeting until I discovered a simple strategy that changed my financial life. This approach divides after-tax income into three clear categories: living expenses, savings, and investments or donations.

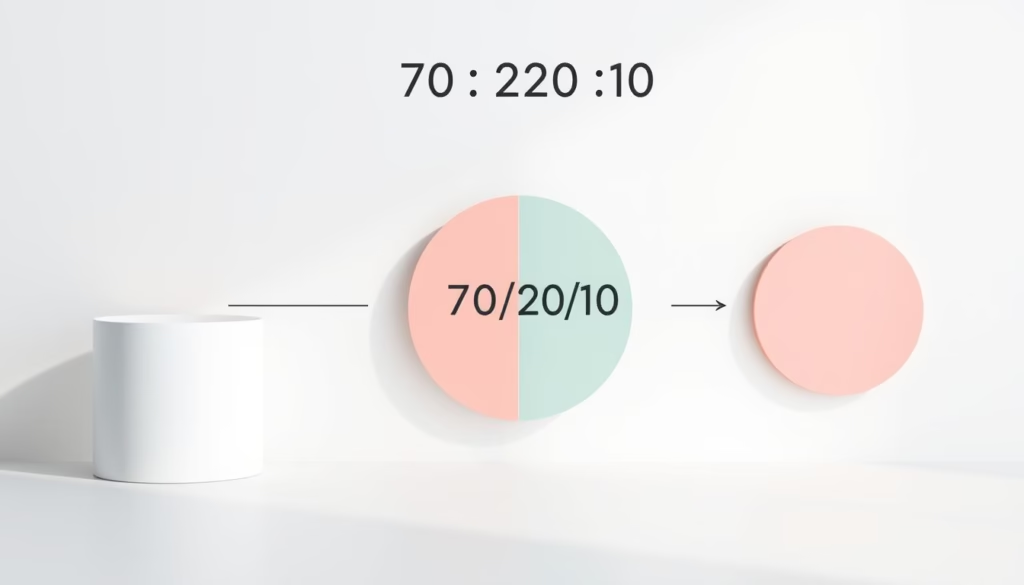

By allocating 70% of my income to cover daily needs like rent and groceries, I ensure my essentials are met. The next 20% goes toward savings and paying off debt, helping me build an emergency fund and reduce financial stress. The remaining 10% is set aside for investments or charitable giving, supporting long-term goals and personal values1.

This method provides a straightforward framework for budgeting without overwhelming details. It’s helped me develop better financial habits and achieve my goals. Whether you’re just starting or looking to refine your approach, this strategy offers a clear path to managing money effectively2.

Key Takeaways

- Divide after-tax income into three categories: living expenses, savings, and investments.

- Allocate 70% for daily needs, 20% for savings and debt, and 10% for investments or donations.

- Build an emergency fund to cover three to six months of expenses.

- Automate savings transfers to stay consistent with your financial goals.

- Adjust allocations as needed to fit your unique financial situation.

Understanding the Basics of the 70/20/10 Budget Rule

Budgeting doesn’t have to be complicated when you break it into clear categories. The 70/20/10 rule simplifies money management by dividing after-tax income into three main areas: living expenses, savings, and investments or donations. This approach ensures every dollar has a purpose, making it easier to track and control spending3.

What the Rule Represents

The rule allocates 70% of income to cover essential needs like rent, groceries, and utilities. These are the costs you can’t avoid each month. The next 20% goes toward savings, helping build an emergency fund or pay off debt. The remaining 10% is reserved for investments or charitable giving, supporting long-term goals and personal values4.

Using percentages makes this strategy universal. Whether you earn $2,000 or $10,000 a month, the same categories apply. This consistency helps create a clear plan for managing money without feeling overwhelmed.

Key Benefits of a Percentage-Based Approach

One of the biggest advantages is simplicity. Instead of tracking dozens of expenses, you focus on three main categories. This reduces stress and makes it easier to stick to your budget.

Another benefit is flexibility. If your living expenses increase one month, you can adjust the other categories accordingly. For example, I’ve found that automating savings transfers keeps me consistent, even when unexpected costs arise5.

This strategy also encourages mindful spending. By understanding where your money goes, you can make better decisions about what you truly need. Over time, this approach helps build financial stability and confidence.

What is the 70/20/10 rule for personal finance?

Balancing income and expenses becomes easier with a structured approach. The 70/20/10 rule divides after-tax earnings into three categories: living costs, savings, and investments or donations. This method ensures every dollar has a purpose, making it simpler to track and manage money6.

Definition and Core Components

The 70/20/10 rule allocates 70% of income to essential needs like rent, groceries, and utilities. These are non-negotiable expenses that must be covered each month. The next 20% is dedicated to savings and debt repayment, helping build an emergency fund or reduce financial burdens. The remaining 10% is reserved for investments or charitable giving, supporting long-term goals and personal values7.

This approach emphasizes the dual role of savings and debt repayment. By prioritizing both, you can address immediate financial obligations while preparing for the future. For example, I’ve found that automating savings transfers keeps me consistent, even when unexpected costs arise7.

Comparison with the 50/30/20 Budget Rule

While the 70/20/10 rule focuses on simplicity, the 50/30/20 method offers a different allocation. It suggests 50% for needs, 30% for wants, and 20% for savings. This approach provides more flexibility for discretionary spending but may not suit those with higher living costs7.

Here’s a quick comparison:

| Budget Rule | Needs (%) | Wants (%) | Savings/Investments (%) |

|---|---|---|---|

| 70/20/10 | 70 | 0 | 30 |

| 50/30/20 | 50 | 30 | 20 |

In tougher financial climates, the 70/20/10 rule often works better. It prioritizes essential expenses and savings, ensuring stability even when income is tight. For instance, during a period of reduced earnings, I adjusted my allocations to focus more on needs and savings, which helped me stay afloat8.

This rule is adaptable for future planning. Whether you’re saving for a home or paying off student loans, the percentages can be tweaked to fit your unique situation. By understanding where your money goes, you can make informed decisions that align with your financial goals7.

Allocating Income: Managing Living Expenses, Savings, and Investments

Structuring your income into clear categories simplifies financial planning. By dividing earnings into specific portions, you can prioritize essential needs while building for the future. This approach ensures every dollar has a purpose, making it easier to track and manage your money effectively.

70% for Daily Living and Essential Expenses

Essential costs like rent, utilities, and groceries should take up the largest portion of your budget. For example, if your monthly take-home pay is $2,500, $1,750 would go toward these necessities9. This ensures your basic needs are met without overspending.

Housing often consumes a significant chunk of this allocation. Experts recommend keeping housing costs below 28% of your gross income10. In high-cost areas, this percentage may rise, but it’s crucial to balance it with other expenses like transportation and childcare.

20% for Savings and Debt Repayment

Setting aside 20% of your income helps build financial security. This portion can go toward an emergency fund, retirement accounts, or paying off debt11. For instance, $500 from a $2,500 income can be split between these goals.

Debt repayment is a critical part of this category. With the average credit card debt reaching $7,236, prioritizing repayments can significantly improve your financial health10. Automating transfers to savings accounts ensures consistency, even during tight months.

Insurance payments also fall under this category. Whether it’s health, auto, or life insurance, these obligations must be factored into your budget to avoid financial strain.

By balancing immediate needs with long-term goals, this allocation strategy fosters stability and confidence. Adjusting percentages as your financial situation evolves ensures the plan remains effective and tailored to your needs.

Real-Life Examples and Customization Tips for the 70/20/10 Rule

Taking control of your finances starts with a clear plan tailored to your unique situation. The 70/20/10 rule provides a framework, but flexibility is key to making it work for you. Let’s dive into practical examples and tips to customize this approach.

Calculating Your Monthly Budget

Start by determining your monthly take-home pay. Subtract taxes and deductions to find your net income. For example, if you earn $3,000 after taxes, allocate $2,100 (70%) to living expenses, $600 (20%) to savings, and $300 (10%) to investments or debt repayment12.

Break down your living expenses into fixed and variable costs. Fixed costs include rent, utilities, and insurance, while variable costs cover groceries, entertainment, and dining out. Tracking these helps identify areas to adjust if needed.

Using a budgeting tool can simplify this process. Apps like Mint or YNAB categorize your spending automatically, making it easier to see where your money goes each month13.

Adjusting Percentages to Fit Personal Needs

Life is unpredictable, and your budget should reflect that. For instance, if you receive a windfall like a bonus or tax refund, consider allocating a portion to savings or debt repayment. This can help you reach your financial goals faster12.

Here’s a real-life example: A family with high childcare costs might adjust their allocations to 60/25/15. This ensures essential needs are met while still prioritizing savings and debt reduction13.

Automating savings transfers is another effective strategy. Setting up automatic deposits ensures consistency, even during tight months. Over time, this habit builds financial security and reduces stress13.

| Scenario | Living Expenses (%) | Savings (%) | Investments/Donations (%) |

|---|---|---|---|

| Default | 70 | 20 | 10 |

| High Childcare Costs | 60 | 25 | 15 |

| Windfall Allocation | 65 | 25 | 10 |

Remember, the 70/20/10 rule is a guideline, not a strict requirement. Adjusting percentages based on your circumstances ensures the plan remains effective and aligned with your goals. Whether you’re saving for a home or paying off student loans, this flexibility is key to long-term success.

Tools and Strategies to Stick with Your Budget

Staying on track with your finances requires the right tools and a solid plan. Over the years, I’ve discovered that automating my money management makes budgeting effortless and effective. By leveraging digital tools, I’ve been able to simplify my financial routine and stay consistent with my goals.

Automating Your Budget and Using Banking Apps

One of the best ways to stay disciplined is by automating your budget. I use online and mobile banking tools to set up recurring transactions, which minimizes the risk of overspending. Features like direct deposit and real-time balance updates keep me informed and in control14.

Monitoring Credit and Savings Accounts

Keeping an eye on my credit and interest-bearing accounts has been a game-changer. By regularly reviewing these, I’ve been able to grow my savings and reduce unnecessary interest payments. A dedicated savings account also helps me separate funds for specific goals, like an emergency fund or a vacation10.

Investment Apps for Long-Term Goals

Planning for the future is easier with investment apps. I use platforms that allow me to contribute to my retirement fund while also exploring other wealth-building opportunities. Automating these contributions ensures I stay on track without having to think about it15.

Personal Tips for Staying Accountable

As a careful person, I’ve found that setting monthly reminders to review my budget keeps me accountable. Apps like Mint and YNAB provide detailed insights into my spending habits, helping me make informed decisions14.

- Automate recurring transactions to minimize overspending.

- Use a dedicated savings account for specific financial goals.

- Monitor credit and interest-bearing accounts regularly.

- Explore investment apps to build long-term wealth.

- Set monthly reminders to review and adjust your budget.

By integrating these tools and strategies into my routine, I’ve been able to manage my finances more effectively. Whether you’re just starting or looking to refine your approach, these tips can help you stay on track and achieve your financial goals.

Financial Benefits of the 70/20/10 Budget in Today’s Economy

Navigating financial challenges becomes manageable with a clear, structured plan. The 70/20/10 approach not only simplifies budgeting but also offers significant long-term advantages. By dividing income into specific categories, it helps reduce stress and supports achieving financial goals, even in uncertain economic times.

Reducing Financial Stress

Following this method has significantly lowered my financial anxiety. Allocating 70% of income to essential needs ensures bills are paid on time, while 20% toward savings builds a safety net. This predictable structure eliminates guesswork and fosters confidence in my financial situation16.

Consistent savings and structured debt repayment have improved my overall profile. For example, automating transfers to a high-yield savings account has grown my emergency fund, covering unexpected expenses without stress17.

Supporting Long-Term Financial Goals

This strategy isn’t just about managing day-to-day living. It’s a powerful tool for building wealth over time. By dedicating 10% to investments, I’ve seen steady growth in my retirement fund, ensuring a secure future18.

Improved credit management has also freed up resources. Lower interest burdens mean more money can be redirected toward long-term goals, like buying a home or funding education17.

Building positive habits is another key benefit. Sticking to this plan has instilled discipline, making it easier to stay on track even when unexpected costs arise. Over time, these habits contribute to lasting financial stability.

In today’s high-cost economy, this budgeting tactic is more relevant than ever. It provides a clear path to managing money effectively, reducing stress, and achieving long-term success.

Conclusion

Achieving financial stability starts with a clear, actionable plan. The 70/20/10 approach has been a game-changer for me, offering simplicity and flexibility in managing money. By allocating income into specific categories, it reduces stress and provides a solid foundation for both short-term needs and long-term goals.

This rule ensures essentials are covered while building savings and tackling debt. For instance, automating transfers to a high-yield account has grown my emergency fund, giving me peace of mind19. The 10% set aside for investments has also helped me prepare for retirement, ensuring a secure future20.

Adapting this budgeting strategy to my financial situation has made it more effective. Whether adjusting percentages or redirecting windfalls, the flexibility of this plan keeps it relevant and practical.

If you’re looking for a straightforward option to improve your finances, consider this approach. It’s a powerful tool for managing everyday expenses and planning for the future. Start today, and take control of your money with confidence.

FAQ

How does the 70/20/10 rule help manage my income?

Can I adjust the percentages in the 70/20/10 rule?

What are the key benefits of using a percentage-based budget?

How does the 70/20/10 rule compare to the 50/30/20 budget?

What tools can I use to automate my 70/20/10 budget?

How can the 70/20/10 rule support long-term financial goals?

What should I do if my living expenses exceed 70% of my income?

How do I calculate my monthly budget using the 70/20/10 rule?

Can the 70/20/10 rule help reduce financial stress?

What if I have irregular income? Can I still use the 70/20/10 rule?

Source Links

- What Is the 70-20-10 Budget Rule? How Does It Work? | SoFi

- Understanding the 70-20-10 Rule and How the Budgeting Technique Works

- What is the 70-20-10 Budget in Personal Finance? – Marietta Wealth

- 70-20-10 Rule: Does It Really Work?

- 70-20-10 Budget Rule: Guide To Mastering Your Finances | Hiatus

- 70-20-10 Budgeting Rule for Financial Planning – appreciate

- Elevate Your Finance Game: The 70-20-10 Budget Explained

- The 70-20-10 money rule: the new and better way to save

- How to Use The 70/20/10 Rule Budget The Right Way – Briana L. Potter

- How to Budget Money: Your Step-by-Step Guide

- What is a 70/20/10 Budget? Understanding the Simple Money Management Framework – STD

- What Is The 70-20-10 Budget?

- The 70/20/10 Rule: Master Budgeting for Financial Success — Ascendant Globalcredit Group

- How to Budget: Master Your Money in 5 Simple Steps

- What Is The 70/20/10 Rule Budget? (With Examples)

- Master your finances with the 70-20-10 budget. Allocate 70% for living expenses, 20% for savings and 10% for debt repayments.

- How to Budget Money: A Step-By-Step Guide – NerdWallet

- The 70-20-10 Rule: Your Roadmap to Financial Success in India

- 70/20/10 Rule Redux

- Understanding the 70 20 10 Rule for Money Management

Generated with Pin Generator